How Eb5 Investment Immigration can Save You Time, Stress, and Money.

Wiki Article

Indicators on Eb5 Investment Immigration You Should Know

Table of ContentsNot known Details About Eb5 Investment Immigration More About Eb5 Investment ImmigrationNot known Incorrect Statements About Eb5 Investment Immigration Get This Report about Eb5 Investment ImmigrationWhat Does Eb5 Investment Immigration Mean?

While we aim to use precise and updated material, it ought to not be considered lawful recommendations. Migration regulations and regulations go through alter, and individual situations can differ extensively. For personalized guidance and legal recommendations regarding your specific immigration circumstance, we highly advise speaking with a certified migration attorney that can give you with tailored support and make sure conformity with current regulations and regulations.

Citizenship, via investment. Presently, since March 15, 2022, the amount of financial investment is $800,000 (in Targeted Work Areas and Backwoods) and $1,050,000 somewhere else (non-TEA zones). Congress has actually approved these quantities for the next five years starting March 15, 2022.

To certify for the EB-5 Visa, Capitalists need to create 10 full time U.S. work within 2 years from the day of their complete investment. EB5 Investment Immigration. This EB-5 Visa Demand guarantees that financial investments add directly to the united state work market. This applies whether the work are produced directly by the company or indirectly under sponsorship of a marked EB-5 Regional Facility like EB5 United

The smart Trick of Eb5 Investment Immigration That Nobody is Talking About

These tasks are identified through designs that use inputs such as development costs (e.g., building and devices costs) or annual incomes produced by recurring procedures. In comparison, under the standalone, or direct, EB-5 Program, only direct, permanent W-2 employee placements within the company might be counted. A key risk of relying solely on straight employees is that staff decreases as a result of market problems could result in not enough full-time placements, potentially resulting in USCIS denial of the capitalist's request if the task creation requirement is not fulfilled.

The economic model then forecasts the variety of straight tasks the brand-new business is likely to develop based upon its anticipated revenues. Indirect jobs determined with financial versions describes work created in sectors that provide the products or services to business straight entailed in the project. These work are produced as a result of the enhanced demand for items, materials, or solutions that sustain the organization's procedures.

The 10-Second Trick For Eb5 Investment Immigration

An employment-based fifth preference classification (EB-5) financial investment visa provides an approach of ending up being an irreversible U.S. homeowner for international nationals wanting to invest funding in the USA. In order to request this environment-friendly card, a foreign financier has to invest $1.8 million (or $900,000 in a Regional Center within a "Targeted Employment Location") and create or protect at the very least 10 permanent work for USA workers (leaving out the investor and their instant family members).

This action has actually been a remarkable success. Today, 95% of all EB-5 funding is raised and spent by Regional Centers. Because the 2008 monetary situation, access to capital has been restricted and municipal budget plans remain to encounter considerable shortages. In numerous areas, EB-5 financial investments have filled up the financing void, providing a new, vital source of capital for regional economic advancement tasks that renew areas, create and sustain work, infrastructure, and solutions.

Not known Details About Eb5 Investment Immigration

employees. Furthermore, the Congressional Budget Plan Office (CBO) scored the program as income neutral, with administrative costs spent for by candidate charges. EB5 Investment Immigration. More than 25 nations, including Australia and the United Kingdom, usage comparable programs to draw in foreign investments. The American program is a lot more strict than numerous others, requiring significant danger for capitalists in regards to both their monetary investment and migration standing.Family members and individuals who seek to move to the United States on a long-term basis can use for the EB-5 Immigrant Capitalist Program. The United States Citizenship and Migration navigate to these guys Solutions (U.S.C.I.S.) established out various requirements to acquire permanent residency through the EB-5 visa program.: The very first action is to discover a certifying financial investment chance.

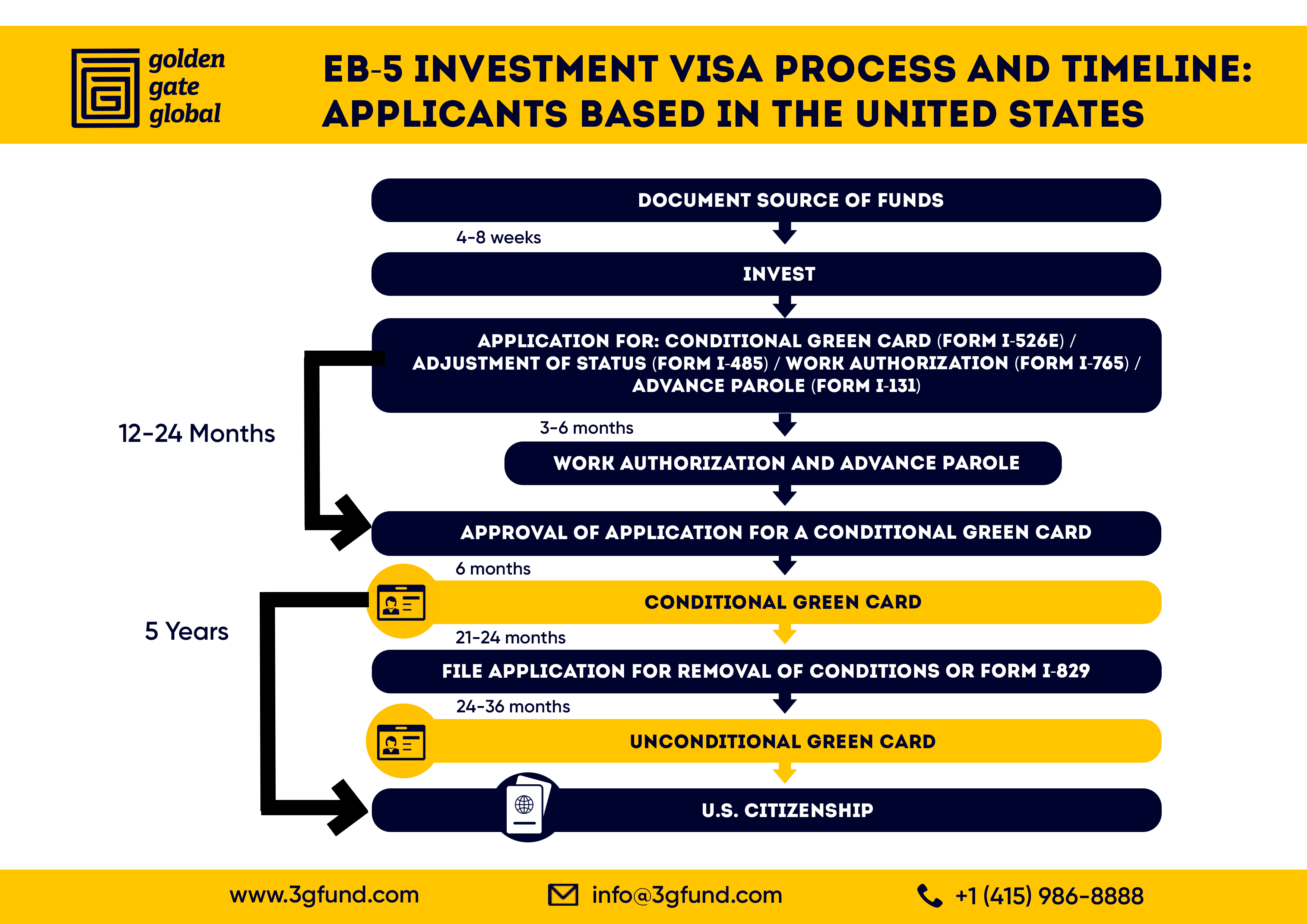

As soon as the possibility has actually been recognized, the investor should make the financial investment and submit an I-526 petition to the U.S. Citizenship and Immigration Solutions (USCIS). This application has to include evidence of the investment, such as bank statements, purchase agreements, and company strategies. The USCIS will evaluate the I-526 request and either authorize it or request added evidence.

Examine This Report on Eb5 Investment Immigration

The investor must request conditional residency by submitting an I-485 petition. This application has to be submitted within six months of the I-526 approval and must include proof that the financial investment was made and that it has created at the very least 10 permanent jobs for U.S. employees. The USCIS will click to read examine the I-485 request and either accept it or request extra proof.Report this wiki page